Global Investors Turn Bullish on India Amid Shifting Economic Winds

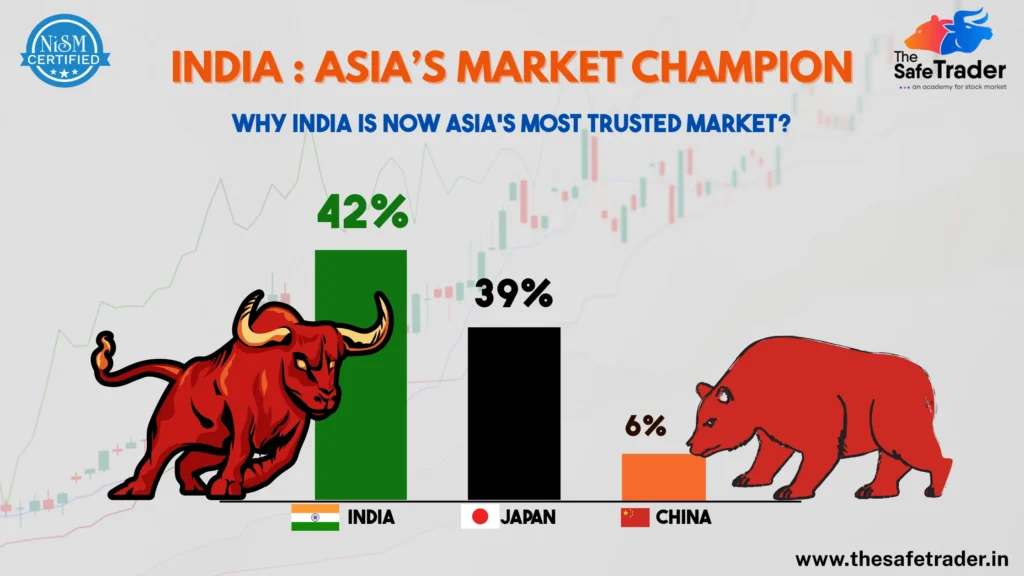

According to the Bank of America Global Fund Manager Survey ( 2025), India has been placed atop the ladder ahead of Japan and China to be Asia’s most preferred equity market. The study reveals investor preferences of the global fund managers of 2025:

- 42% would prefer India,

- 39% would favour Japan,

- while only 6% favoured China.

This is a deep change in sentiment which might very well set the course for Asia’s financial landscape in the coming years.

Why Global Investors Are Betting Big on India

The Indian stock market is not just “hot”; it is really undergoing structural evolution, and these are the reasons why bullishness is ultimately charging through:

1. World’s Fastest-Growing Major Economy

In FY25, India is expected to grow anywhere between 6.8 and 7.2 percent, faster than any other G20 economy. Despite a lackluster external environment, India has remained resilient in the macroeconomic front, a strong consumer base, and consistent corporate earnings.

2. FII Inflows at All-Time Highs

More than ₹1.2 lakh crore have been poured by Foreign Institutional Investors (FIIs) into Indian shares in mere Q1 of 2025. Sectors in limelight are:

- Banking & Financial Services

- Green Energy & EV

- Telecom & Digital Infrastructure

- Manufacturing under PLI schemes

Global capital now views India as core allocation, not just a satellite emerging market.

3. Geopolitical Advantage Over China

Growing US-China tensions, regulatory clampdown in Beijing, and opaque capital markets have all pushed investors to opt for diversification away from China, with India being a prime alternative:

- Democracy and transparency

- Legal protection to foreign investors

- Tech-driven reforms

4. Stable & Reform-Oriented Government

Political stability in India, under a reform-oriented regime, has given a further push to investor confidence:

- Simplification of tax structures (GST)

- Digitalisation of public services

- Infrastructure boom: ₹111 lakh crore planned under National Infrastructure Pipeline

Data-Driven Market Sentiment

| Country | Investor Preference | Key Strength |

| India | 42% | Growth, Reforms, Demographics |

| Japan | 39% | Safe haven, mature tech sector |

| China | 6% | Declining due to policy risk |

Notably, India’s outperformance vs China reflects global trust in economic governance and scalability.

Technical & Market Indicators (as of May 2025)

- Nifty 50: 24,975.70

- Sensex: 82,205.55

- India VIX is reported at 16.62.

- Foreign Portfolio Investors (FPIs) have shown renewed interest in Indian equities, with net purchases of ₹11,663 crore in May so far, following ₹3,416.08 crore in April .

India vs Japan vs China: Comparative Analysis of Asia’s Top Stock Markets

The investor sentiment shift is more than just a popularity contest—it’s based on real, measurable differences across these three economic powerhouses. Here’s how India, Japan, and China compare across critical dimensions that matter to investors.

| Category | India | Japan | China |

| Investor Preference | 42% (Rank #1) | 39% (Rank #2) | 6% (Rank #3) |

| GDP Growth (2025 est.) | 6.8% – 7.0% | 1.1% – 1.5% | 4.5% – 5.0% |

| Population Dynamics | Young, median age ~28 | Ageing, median age ~49 | Median age ~39, but declining |

| Stock Market Returns | Strong; Nifty/Sensex rising | Stable; Nikkei at record highs | Volatile; regulatory concerns |

| Reform Momentum | High – digital, manufacturing | Moderate – governance-focused | Low – unpredictable policies |

| Ease of Doing Business | Improving rapidly | Very high | Declining due to crackdowns |

| Foreign Investment | Growing FDI/FII inflows | Stable, mature inflows | Declining due to capital flight |

| Geopolitical Risk | Low to moderate | Low | High (US tensions, Taiwan issue) |

| Innovation & Tech | Rapid growth in fintech, AI | Strong in robotics, automation | Leading in AI, but restricted |

| Market Transparency | Improving regulatory framework | High regulatory maturity | Low due to state control |

Investment Outlook. What Should Traders Do?

For stock traders, investors, and learners at The Safe Trader Academy, this shift presents major opportunities:

Strategic Takeaways:

- In view of the rotation by FIIs into mid-cap and infrastructure growth spaces, focus on Indian mid-caps and infrastructure stocks.

- Use technical analysis to track breakout patterns in Nifty Bank, FMCG, and PSU stocks.

- Short-term volatility shall be generated by announcements of RBI policies and quarterly earnings.

- Long term view: India equity market continues to have a long runway ahead.

Conclusion:

The era of “Will India Rise?” has now transformed to “How far and how fast are they going to rise?”

With favorable demographics, digital momentum, and global capital flowing in, India isn’t just Asia’s hottest stock market—it’s the new growth engine of global equity markets.

Whether you’re a retail investor, institutional fund manager, or an aspiring trader, India is the market to watch—and to act on.

👉 Enroll today and become a smarter, safer trader.