In the world of Stock Market Trading, the varieties of time frames and charting intervals are of utmost importance; they basically serve as the cornerstones of your trading strategy. From those that engage in long-term investing to those who engage in scalping by minutes, all of these traders should be fully aware of how time frames sync up with their goals, psychology, and available time.

In this blog, we analyze the Time Frame Guide by The Safe Trader, a NISM-certified mentor that empowers traders in India. Let’s now proceed to understanding the details of various trading styles and how to relate them to your suitable time horizon.

What is a Time Frame in Trading?

A Time Frame is the length of time in which a price chart undergoes analysis in technical or trading decisions. In other words, whether you are observing the price movement shown by a candlestick every 15 minutes or the price movement on a daily or weekly chart, your time frame encompasses:

- The frequency of trades

- Duration of holding

- Risk and reward expectations

- Strategy and indicators used

Each style of trading coincides with a particular time frame and outlook- ranging from long-term investing to ultra-short-term scalping.

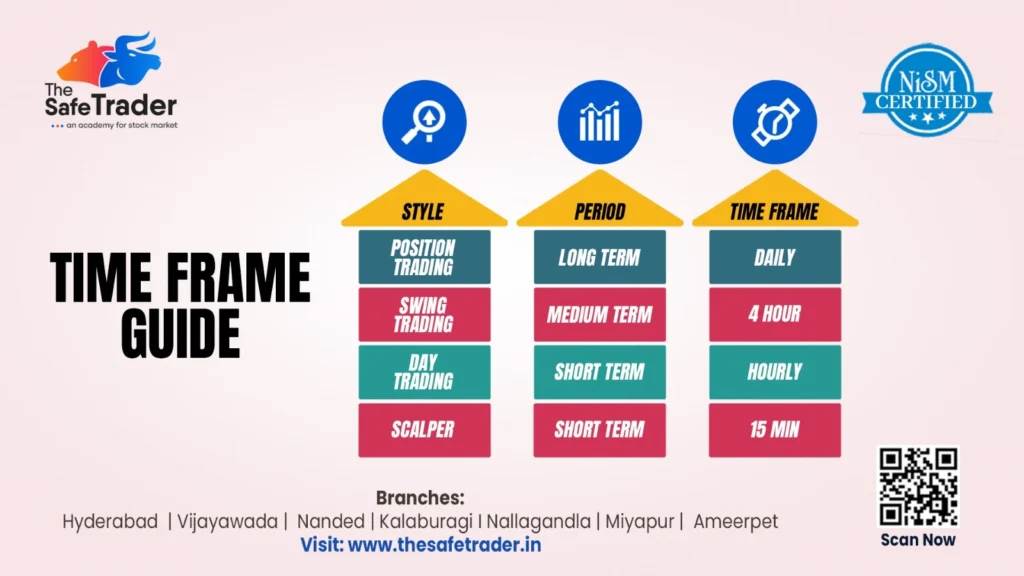

Time Frame Guide for Traders: Styles, Periods & Time Frames

1. Position Trading (Long-Term)

- Period: Long Term

- Time Frame: Daily

- Best For: Long-term investors and professionals who prefer minimal intervention.

- Strategy: Uses fundamental analysis (earnings, valuation, news).

- Example: Buying a fundamentally strong stock like Infosys or HDFC Bank and holding it for 6 months to 2 years.

Pros:

- Low stress and fewer trades

- Takes advantage of major trends

- Ideal for people with jobs or other businesses

Cons:

- Requires patience

- Misses short-term opportunities

2. Swing Trading (Medium-Term)

- Period: Medium Term

- Time Frame: 4 Hour

- Best For: Part-time traders who want to profit from medium-term trends.

- Strategy: Combines technical analysis and market momentum.

- Example: Buying a breakout stock during a sector rally and holding it for a few days or weeks.

Pros:

- Balances risk and reward

- Less screen time than day trading

- Effective for trending markets

Cons:

- Requires weekend planning

- Sensitive to overnight gaps

3. Day Trading (Short-Term)

- Period: Short Term

- Time Frame: Hourly

- Best For: Full-time traders with access to real-time charts and quick execution.

- Strategy: Focuses on intraday price movements, volatility, and volume patterns.

- Example: Taking trades on Bank Nifty during high volume periods like market open or close.

Pros:

- No overnight risk

- Daily income potential

- Fast feedback on strategy

Cons:

- Emotionally intense

- Requires constant focus

4. Scalping (Ultra Short-Term)

- Period: Short Term

- Time Frame: 15 Min

- Best For: Expert traders who thrive in high-speed environments.

- Strategy: Capitalizes on tiny price changes. Trades last from seconds to minutes.

- Example: Scalping 5–10 points on Nifty Futures multiple times during market hours.

Benefits:

- Fast gains with multiple trades

- Exploits short-term inefficiencies

- Great for volatile instruments

Drawbacks:

- Requires lightning-fast decisions

- Can be stressful and mentally exhausting

Learn From the Best – The Safe Trader Academy

Their courses cover:

- Technical & fundamental analysis

- Risk management

- Strategy building for different time frames

- Live market practice sessions

The modules aim to prepare students for a safer trade experience, whether they be college students, working professionals, or budding traders.

Bonus Strategy: Multi-Time Frame Analysis (MTFA)

Professional traders often combine multiple time frames to improve their accuracy and timing.

How it works:

- Higher Time Frame (HTF): Identifies overall trend (e.g., daily)

- Mid Time Frame (MTF): Confirms setup (e.g., 4-hour)

- Lower Time Frame (LTF): Triggers entry/exit (e.g., 15-min)

Example:

A swing trader checks:

- Daily chart: Trend is bullish

- 4-Hour chart: Price breaks resistance

- 15-Minute chart: Entry confirmed with volume spike

MTFA = Bigger picture + Better timing.

Psychology & Time Frames: Trading Time Frame Analysis

Each trading style demands a different mindset:

| Style | Requires | Suits |

| Position Trading | Patience, trust in fundamentals | Long-term thinkers |

| Swing Trading | Tactical execution, patience | Part-time traders |

| Day Trading | Focus, speed, strategy | Full-time professionals |

| Scalping | Ultra-discipline, low latency | Advanced traders |

Note: Don’t copy others blindly. Know your emotional strength, risk tolerance, and time commitment before choosing a Trade.

Common Mistakes to Avoid

- Switching Time Frames Frequently – Leads to confusion and poor decision-making

- Using the Same Indicators Over All Time Frames: Different time frames require different settings (e.g., RSI 14 on daily ≠ RSI 14 on 15-min).

- Ignoring Risk-Reward Ratio: It burns you in short-term trading even more.

- Overtrading in Scalping or Day Trading: More trades do not necessarily mean more profits.

- Not Using Stop-Losses: Time frames don’t protect you from poor discipline

Tools & Indicators Used by Best Time Frame in Stock Market

Different time frames demand different tools and techniques. Here’s a breakdown of what traders commonly use at each level:

| Time Frame | Common Indicators | Tools |

| Daily | Moving Averages, RSI, MACD, Trendlines | Fundamental reports, Daily charts |

| 4 Hour | Bollinger Bands, Fibonacci Retracements, RSI | TradingView, Price Action, Swing Setups |

| Hourly | VWAP, Support/Resistance, Breakout Zones | Intraday charts, Sector strength analysis |

| 15 Min | EMA (9/21), Volume, Momentum Oscillators | Fast-execution brokers, Level 2 data, Scalping bots |

The Safe Trader Advantages:

What sets The Safe Trader apart?

✅ NISM-Certified Trainers

✅ Live Trading Sessions

✅ Customized Courses by Style

✅ Practical Learning + Psychological Coaching

✅ Supportive Community of Like-Minded Traders

Whether you’re starting out or aiming to go pro, their step-by-step training on Time Frame Strategies ensures you’re always trading with purpose.

Time Frame for Technical Analysis: Match Your Time Frame to Your Goals

| Your Profile | Best Time Frame |

| Working Professional | Daily / 4 Hour (Swing/Position) |

| College Student | Hourly / Daily (Day/Swing) |

| Full-Time Trader | 15 Min / Hourly (Day/Scalping) |

| Investor | Daily / Weekly (Position) |

Choose one time frame, build mastery, then explore others.

Final Thoughts: Time Frame in Stock Market

The difference between a struggling trader and a consistent one often comes down to clarity of time frame. It’s your lens, your battlefield, your compass.

🔑 Understand it.

🔒 Stick to it.

📈 Master it.

If you’re serious about building a strategy-based trading journey, The Safe Trader Academy has your back — in the classroom, in the markets, and in your mindset.