The Bank Nifty Index, India’s benchmark banking sector index, made headlines today by surging to a new all-time high of ₹57,049.50, supported by strong policy action from the Reserve Bank of India (RBI) and a sharp rebound in banking stocks. This milestone marks a significant shift in market sentiment, especially for financials that have been lagging behind tech and FMCG sectors over the past year.

Let’s break down what led to this breakout, what it means for market participants, and how you can position yourself accordingly.

RBI’s Liquidity Push: The Catalyst Behind the Rally

The RBI’s recent surprise moves have played a central role:

- Repo Rate Cut by 50 bps: The repo rate was cut to 5.5% with the intention of suiting credit growth and economic activity. It is the clearest pivot the central bank has displayed-from the earlier hawkish to now accommodative.

- CRR Cut by 100 bps: The Cash reserve ratio was down by 100 bps, flooding the Indian banking system with almost ₹2.5 lakh crore. This has improved liquidity and let banks lend more aggressively and at much lower costs.

Liquidity-enhancing measures through these twin policy tools are the RBI’s way to provide some short-term stimulus to growth while continuing to invest in inflation control measures in the long run.

Sector-Wise Breakdown: Bank Stocks on Fire

Here’s how key banking players moved in today’s session:

| Bank Name | Price Change | Reason for Movement |

| Kotak Mahindra | +2.1% | Strong credit growth forecast, lower CoF |

| Canara Bank | +2.7% | PSU banking rally + robust NIM projections |

| Axis Bank | +1.9% | Attracted fresh FII inflows |

| PNB | +3.4% | Mid-cap PSU favorite, under-ownership lifted |

| AU Small Finance | +2.3% | Benefit from micro-loan demand surge |

| ICICI Bank | -0.2% | Slight correction after recent rally |

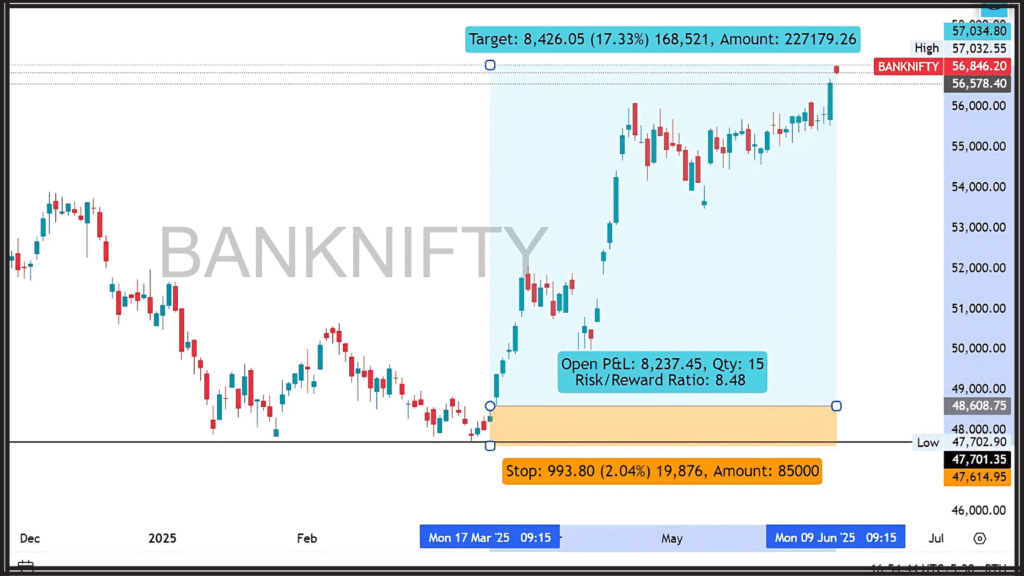

Technical Analysis: Breakout or Bull Trap?

- Previous Resistance Broken: Bank Nifty had faced an intense resistance around ₹56,800–₹57,000. Clean highs with high volume above these Vogue Prices are a validation of bullish momentum.

- Indicators: An RSI crossing of 70 is an overbought sign-but during vigorous upward moves, the RSI can remain high.

- Next Target: Fibonacci extension suggests near-term upside pressure at ₹58,300–₹58,500.

- Support Zones: Immediate support rests around at ₹56,600. A breach of this level may invite selling pressure on profits.

👉 Pro tip to traders: A trailing stop-loss can be placed below support to ride the momentum while protecting profits.

Market Sentiment & Institutional Support

🔍 FII & DII Action:

- Foreign Institutional Investors (FIIs) have turned to net buying of Indian equities for the last three trading sessions, putting in over ₹6,000 crore, especially for BFSI stocks.

- Domestic institutional investors (DIIs) also continued buying PSU banks like Bank of Baroda, SBI, and Canara Bank, signaling domestic confidence in economic resilience.

🧭 Sentiment Drivers:

- Easing inflation and GDP growth of 6.8% YoY (from the latest Q4 FY25 data) have set the macro tones behind a bullish risk appetite led by banking.

- With the rise in credit demand from MSMEs and recovery in corporate capex, investors feel more optimistic.

A Quick Flashback: Bank Nifty’s Journey

| Year | Bank Nifty Approx Level | Key Events |

| 2020 | ~20,000 | COVID-19 crash |

| 2021 | ~36,000 | Economic recovery begins |

| 2022 | ~41,000 | High inflation, rising interest rates |

| 2023 | ~44,000 | Banking earnings strengthen |

| 2024 | ~51,000 | Pre-election rally |

| 2025 | ₹57,049.50 | Record high post-election + RBI policy support |

Macro Trends Supporting the Rally

- Asset Quality Improvement: NPAs have been coming down on a consistent basis, thus strengthening the balance sheets.

- Stable Inflation: CPI inflation remains within the RBI’s target band, thus supporting flexibility to the central bank.

- Corporate Credit Cycle: Higher demand from MSMEs, infrastructure projects, and rural lending would have a silver lining of loan book growth.

- Global Liquidity: FIIs have been net buyers in India, with a large chunk of investments going into financials due to elevated risk-reward trade-offs.

What This Means for Stakeholders

✅ For Traders:

- Short-term trend-following times are ideal.

- Look for breakout trades in medium-sized private banks or selected PSU banks.

- Use intraday and swing-trading opportunities with high-beta bank stocks.

✅ For Long-Term Investors:

- This ATH confirms strength in Indian banking.

- Focus on banks with digital lending capability, healthy CASA ratios, and good provisioning.

✅ For Portfolio Managers:

- Overweight banking sector stocks, which may outperform Nifty50 over the forthcoming 2 to 3 quarters.

- Remain diversified within financials: NBFCs, private banks, and PSU recovery plays.

Conclusion: The Bull Is Back in Banking

The all-time high of ₹57,049.50 isn’t just a number — it signals that India’s banking system is entering a new growth phase, backed by:

- Pro-business central bank policies

- Robust credit growth

- Improving asset quality

- Renewed investor interest post elections

With macroeconomic conditions favouring a pro-liquidity environment, the banking sector may continue to outperform — potentially leading the broader market rally for the rest of 2025.

FAQs

Q1. Why did Bank Nifty hit an all-time high today?

➡ Due to the RBI’s surprise repo rate and CRR cuts, improving liquidity, reducing bank funding costs, and triggering a buying spree in banking stocks.

Q2. What is the next target for Bank Nifty?

➡ Technically, ₹58,500 is the next resistance. Above that, ₹60,000 is possible in the coming weeks if the uptrend holds.

Q3. Is this a good time to invest in banking stocks?

➡ For long-term investors: yes, selectively. Look for banks with solid fundamentals and good digital transformation metrics.

Q4. What risks could pull Bank Nifty down?

➡ Global uncertainty, unexpected inflation spikes, or RBI tightening in future if inflation flares up again.

Q5. Which banks are top picks post this breakout?

➡ ICICI Bank, HDFC Bank, Canara Bank, Kotak Mahindra, and AU Small Finance Bank.

👉 Join The Safe Trader Academy today and start trading like a pro.