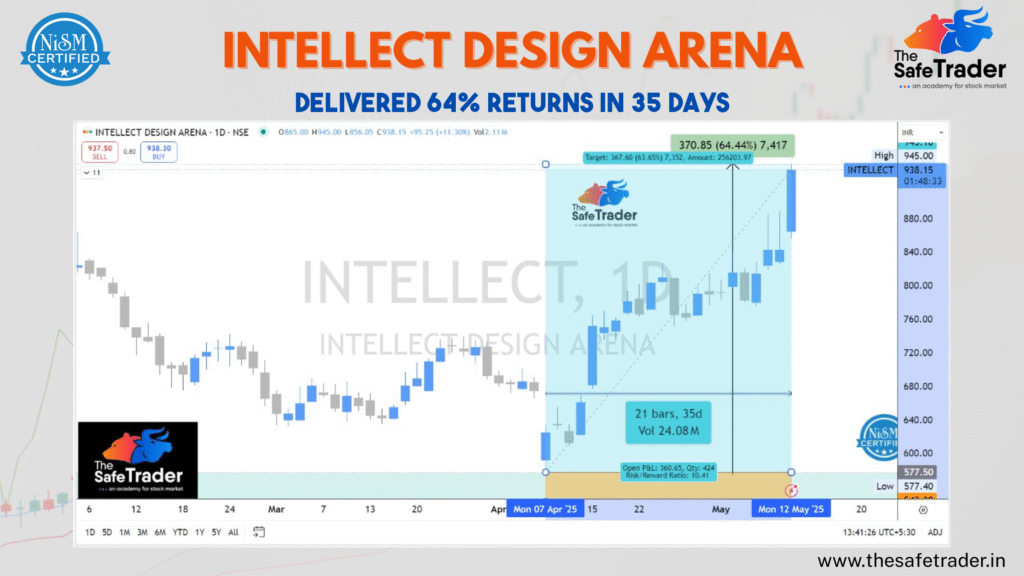

Sometimes, the perfect opportunities arise in the stock market-for strategy, timing, and risk management. Another opportunity came along in INTELLECT DESIGN ARENA (NSE: INTELLECT)-an instant trade that gave returns of 64.44 per cent in just 35 days.

At The Safe Trader Academy, we teach students how to identify high-probability setups like this with real-time charts, volume analysis, and risk management. Let’s analyze this trade and see why it turned into a textbook breakout.

Trade Overview

- Stock Name: Intellect Design Arena

- Entry Date: April 7, 2025

- Entry Price: ₹577.40

- Target/Exit Price: ₹938.15

- Return: ₹370.75 per share

- Percentage Gain: 64.44%

- Holding Period: 35 Days (21 Trading Sessions)

- Volume Traded: 24.08 Million

- Risk/Reward Ratio: 10.41

The chart showed a clear breakout with price action and volume alignment—exactly the kind of setup we train our students to recognize.

Technical Breakdown

✅ 1. Breakout Confirmation

April 7 witnessed the breakout of the stock price from a consolidation zone, closing on a strong bullish engulfing candle. It was a type of movement witnessed with a sharp rise in volume, the hallmark of institutional action.

✅ 2. Volume Validity

Volume maintained its upward trend during the upmove, further asserting the validity of the breakout. This helped traders continue holding on as prices rallied.

✅ 3. Trend Creation

After the breakout, the stock went on to create higher highs and higher lows, ultimately sustaining the notion of a strong uptrend. The support zones stayed pleasantly firm throughout the trade.

✅ 4. Risk-Reward Ratio Management

The trade had a risk/reward ratio of 10.41, minimizing downside with maximum upside potential-this is what smart swing trading is all about.

Key Learnings for Traders

Trade highlights several important lessons on tending to the market:

- Enter on breakout after confirmation

- Do use volume as a filter for decisions

- Always stick to the preset risk-reward assignments

- Avoid emotional exits; just stick to the setup

At The Safe Trader Academy, we teach not just strategies; we teach the mindset and execution that lead to consistent results.

The Safe Trader Way

At The Safe Trader Academy, we don’t sell hype. We teach precision. Trades like this are the outcome of structured learning, live practice, and disciplined decision-making. Whether you’re new to the markets or looking to refine your edge, our academy is built for you.

Want to learn how to spot setups like INTELLECT before they break out?

The INTELLECT trade was not luck—it was a preparation meeting opportunity. If you want to learn how to spot breakout setups like this and trade them with confidence, join our next batch today.

👉 Enroll today and become a smarter, safer trader.