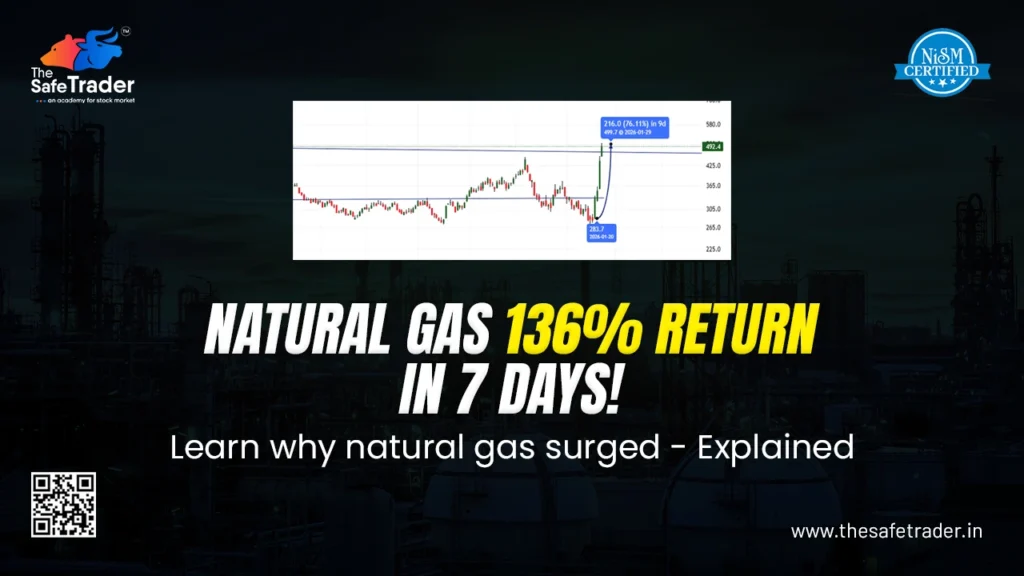

Natural Gas 136% Return in 7 Days – Reasons & Analysis

The market’s traders and investors were taken surprise by Natural Gas’s 136% return in just 7 days. This rapid price spike is something you should fully understand if you follow commodities trends or wish to trade strategically. We at The Safe Trader Academy assist you in understanding these market movements and converting volatility into opportunity. Why Natural Gas 136% Return in 7 Days Happened A significant gap between supply and demand is the primary cause of the Natural Gas 136% Return in 7 Days. Natural gas is just one of the energy markets that respond swiftly to shortages. Prices move quickly as supply becomes scarce and demand spikes. Prices were further impacted by weather, storage issues, and changes in the world’s energy supply. Knowing these triggers allows traders to take early action rather than waiting until the last minute. Coal Demand Increase Driving Natural Gas Prices The rise in coal demand is one of the main causes of the Natural Gas 136% Return in 7 Days. Natural gas began to replace coal in power plants and other industries. There was tremendous demand pressure as a result of this sudden shift. Natural gas becomes the preferable substitute when coal becomes costly or scarce. Prices quickly increased as a result of this change in demand. We explain how interconnected markets, such as coal and gas, impact one another in our share market courses. Fire Price Increase and Energy Cost Pressure The rapid price increase in the energy sector is another significant factor contributing to the Natural Gas 136% Return in 7 Days. Industries were compelled to acquire energy supply at any cost due to rising fuel and manufacturing expenses. The price movement was accelerated as traders rushed to purchase natural gas contracts as fire prices rose. Instead of chasing prices impulsively, traders can stay ahead of market momentum by understanding such cost-based triggers. What This Means for You as a Trader The Natural Gas 136% Return in 7 Days proves one important lesson: markets reward knowledge, not guesswork. Even though these returns seem appealing, trading without an awareness of risk can be risky. This is where structured learning becomes essential. With Stock Market Courses Online & Offline, you learn: Learn Stock Market Trading Courses Designed for Beginners & Professionals Professional Trader Program 👉 Join Professional Trader Program Technical Analysis Course 👉 Enroll in Technical Analysis Course in India Futures & Options Course 👉 Join Futures and Options Trading Course Forex & Crypto Trading Course 👉 Start Forex and Crypto Course in India Equity Investment Course 👉 Learn Equity Investment Smart Money Concepts Course 👉 Explore Smart Money Concepts What Makes The Safe Trader Academy #1? At The Safe Trader Academy, learning is practical, action-based, and personalized to your goals. Here’s what makes our courses truly stand out: ✅ Tools & Software for Trading & Investing✅ Basics of Indian Share Market✅ Equity Investment✅ Fundamental & Technical Analysis✅ Futures & Options✅ Forex & Commodity Trading✅ Powerful Intraday Trading Strategies✅ Online & Offline Classes Available✅ Live Market Analysis & Handholding (3 Months)✅ 500+ Real-Time Market Assignments✅ One-on-One Interaction with Our Trainer & CEO✅ Zoom Recordings for Every Class✅ Intraday Setup for Indian and Forex Markets✅ Free Access to Upcoming Batches Your trading journey can be completely changed by a great mentor. Industry expert Mr. Mallinath Mulage, a certified mentor with more than five years of experience and 5 NISM certifications, is the instructor for our stock market trading courses online at The Safe Trader Academy. Enroll Today – Start Your Professional Trading Journey Choosing the Best Stock Market Academy in India can transform your financial future if you’re serious about trading and investing. The Safe Trader Academy stands out among all the options because of its hands-on training, professional mentoring, and track record of student success. Read more: Technical Analysis Course India | Future and Options Trading Course | Equity Investment Course | Professional Stock Trading Course | Smart Money Concepts market classes 👉 Website: www.thesafetrader.in👉 Phone/WhatsApp: +91 9297506666 Disclaimer:The information provided here is purely for educational and informational purposes only and reflects our personal analysis and opinions. This course is for educational purposes only. We are not SEBI-registered advisors.

World’s Top 10 Cryptocurrencies: Beginner Guide

A Crypto Trading Course in India might be your best option if you are unfamiliar with digital assets. Before making any investments, it is crucial to understand the leading cryptocurrencies, which are digital currencies that are traded worldwide. This beginner guide will help you get started, regardless of your interest in trading bitcoin, investing in Ethereum, or investigating other promising coins. Whoever who wants to enter digital markets must learn how to trade cryptocurrencies. The Safe Trader Academy offers specialized programs, including Forex Trading and Crypto Trading Courses in India. These courses are intended to assist beginners in understanding successful strategies, risk management, and market trends. Top 10 Cryptocurrencies to Watch Here’s a list of the most trusted and widely traded cryptocurrencies for beginners: 1. Bitcoin (BTC) Bitcoin, the original and most valuable cryptocurrency, continues to be the benchmark for novice cryptocurrency traders. Long-term investment strategies benefit greatly from it. 2. Ethereum (ETH) Since Ethereum introduced smart contracts, investing in Ethereum is crucial. It is a great option for beginning investors due to its adaptability. 3. Binance Coin (BNB) The Binance ecosystem makes extensive use of BNB, which is well-liked for its trading and transaction fee reductions. 4. Solana (SOL) Solana is becoming more popular among traders and developers due to its quick transaction speeds. 5. XRP Cross-border payments are the main application for XRP, which provides investors with stability and usefulness. 6. Cardano (ADA) Cardano is a secure choice for beginner cryptocurrency enthusiasts because it emphasizes sustainability and scalability. 7. Avalanche (AVAX) For beginners investigating DeFi platforms, Avalanche offers robust security and quick transactions. 8. Polkadot (DOT) By connecting several blockchains, Polkadot enables interoperability, which is essential for long-term investment. 9. Tron (TRX) Tron is well-liked for blockchain projects with an entertainment focus and decentralized applications. 10. Litecoin (LTC) Litecoin, sometimes referred to as “digital silver,” is quicker than Bitcoin and a good place for beginners to start. How a Crypto Trading Course Helps Enrolling in an Indian Crypto Trading Course enables beginners to: The Safe Trader Academy provides the best courses for beginners in stock market and crypto trading, helping you build confidence before trading with live capital. Start Your Crypto Journey Today Take the first step toward wise and knowledgeable digital investing by enrolling in The Safe Trader Academy’s Crypto Trading Course in India, regardless of your level of expertise in trading Bitcoin or learning about other popular cryptocurrencies. Read more: Technical Analysis Course India | Future and Options Trading Course | Equity Investment Course | Professional Stock Trading Course | Smart Money Concepts Course 👉 Website: www.thesafetrader.in👉 Phone/WhatsApp: +91 9297506666 The information provided here is purely for educational and informational purposes only and reflects our personal analysis and opinions. This course is for educational purposes only. We are not SEBI-registered advisors.

Which Time Frame Is Best for XAUUSD (Gold) Traders?

Best Time Frame for XAUUSD Trading Selecting the appropriate time frame is essential for success when trading XAUUSD. Knowing the ideal time frame for gold can make all the difference in managing risk and optimizing gains, regardless of whether you’re new to gold forex trading or trying to improve your XAUUSD strategy. What Is a Time Frame in XAUUSD Trading? A time frame, such as 5 minutes, 15 minutes, an hour, or a day, illustrates how the price of gold changes over a given time period. Understanding time frames can help beginning gold traders match their trading style to market volatility. Longer time frames enable you to capture larger trends, while shorter ones are best for quick trades. Best Time Frames for XAUUSD Traders When deciding your XAUUSD strategy, it’s important to match your trading style with the right time frame. Here’s a breakdown: Scalping: M5, M15 Scalping on the 5-minute (M5) or 15-minute (M15) charts is optimal for traders who prefer quick trades and modest profits. This is ideal for gold forex traders looking for high activity, but it does require focus and fast decision-making. Intraday Trading: M15, H1 (Best for Beginners) Intraday trading on 15-minute (M15) and 1-hour (H1) charts is best for beginner XAUUSD traders. Stop-loss orders can be placed more effectively due to these time frames’ distinct trends and managed risk. Swing Trading: H4, Daily Swing traders concentrate on more significant changes in the market. Making profitable trades in gold forex trading is made easier by using the 4-hour (H4) and daily charts to identify long-term trends. Best Recommendation for Beginners The suggested combination for beginner gold traders is: 15-Minute (M15) + 1-Hour (H1) Charts This combo provides: You can improve your XAUUSD strategy and boost your confidence in the volatile gold market by using this strategy. Why Learning From Experts Matters It takes more than just choosing a time frame to trade gold successfully. Proper training ensures you: Conclusion: Start Your XAUUSD Trading Journey Today A key first step in successful XAUUSD trading is determining the ideal time frame for gold. The 15-minute (M15) and 1-hour (H1) charts offer clear trends, improved risk management, and efficient stop-loss placement for beginners. This straightforward but effective strategy can give you the assurance you need to make wise trading choices in the volatile gold market. However, mastering gold forex trading requires appropriate training, strategy, and mentorship in addition to selecting the appropriate charts. One of the best stock market training institutions in India, The Safe Trader Academy, can help you with that. Our courses on forex trading and crypto trading course teach you: You will learn it with the help of real-life market examples, trading strategies through a session approach, and expert risk management techniques that will provide you with clarity and confidence enough to trade XAUUSD like a pro. Don’t wait – enroll in our Forex & Crypto Trading Course in India today and take the first step to becoming a professional XAUUSD trader for a successful trading career. Read more: Technical Analysis Course India | Future and Options Trading Course | Equity Investment Course | Professional Stock Trading Course | Smart Money Concepts Course 👉 Website: www.thesafetrader.in👉 Phone/WhatsApp: +91 9297506666 Disclaimer:The information provided here is purely for educational and informational purposes only and reflects our personal analysis and opinions. This course is for educational purposes only. We are not SEBI-registered advisors.

What Is a Stable Coin?

A stable coin is a kind of cryptocurrency that is perfect for beginner cryptocurrency traders because it is made to maintain a steady value. Stable coins offer a more secure starting point for learning the fundamentals of cryptocurrency trading than other cryptocurrencies, whose values can change dramatically. If you’ve been wondering, “what is USDT?”, it’s one of the most popular stable coins in the market. Stable coins serve as a link between digital and conventional money. They help investors avoid the extreme volatility associated with cryptocurrencies like Bitcoin or Ethereum because they are typically linked to assets like gold or a fiat currency like the US dollar. Example of Stable Coins Let’s examine a few basic examples to better understand cryptocurrency stable coins: Compared to other cryptocurrencies, which can fluctuate significantly in a matter of hours, these coins have a steady value. They are perfect for learning the fundamentals of cryptocurrency trading or for real-world uses like international transfers because of their stability. Popular Stable Coins Some of the most trusted crypto stable coins include: If you are looking to take a Forex & Crypto Trading Course in India or know how to manage trading risks, you must learn about these coins. Uses of Stable Coins There are multiple useful applications for stable coins, particularly for beginners and active traders: By using stable coins strategically, you can start learning crypto trading basics safely and build confidence before exploring more volatile digital assets. Why Beginners Should Learn About Stable Coins Getting started with stable coins is simple: Joining the Best course for beginners in stock market helps you learn practical applications, ensuring you use stable coins effectively without unnecessary risk. The Safe Trader Academy provides guidance and hands-on training to make this process easy and safe. Start Your Stable Coin Journey Today For those who are new to cryptocurrency trading, stable coins are an important tool. Stable coins offer a secure, beginner-friendly choice whether you want to avoid volatility, make quick transfers, or try out the fundamentals of cryptocurrency trading. Enroll in Share Market Courses in India at The Safe Trader Academy to take the first step and get practical experience with stable cryptocurrency. Discover what USDT is, investigate stable coin cryptocurrency, and navigate the stock and cryptocurrency markets with assurance. 👉 Website: www.thesafetrader.in👉 Phone/WhatsApp: +91 9297506666

What are the top 10 currency pairs for forex trading?

Top 10 Currency Pairs for Forex Trading: A Beginner’s Guide The top 10 currency pairs for forex trading are essential for any beginner looking to start a profitable Forex journey. Selecting the appropriate currency pairs lowers risk, increases trading effectiveness, and facilitates learning. Focusing on the top 10 currency pairs for forex trading provides you with low spreads, high liquidity, and predictable price action if you trade currencies in India. What Are Currency Pairs in Forex Trading? The value of one currency in relation to another is displayed in a currency pair. EUR/USD, for instance, indicates how many US dollars are required to purchase one euro. Beginners can trade with confidence and spot potential gains without being overtaken by volatility by knowing the top ten currency pairs for forex trading. The Top 10 Currency Pairs for Forex Trading Here are the best forex pairs for beginners, ranked for liquidity, stability, and profit potential: 1. EUR/USD – Most Traded Pair The most popular pair in the world is EUR/USD. It is perfect for beginners because it provides low spreads, high liquidity, and predictable trends. 2. USD/JPY – Smooth and StableThis pair is ideal for learning the fundamentals of forex trading because of its steady movements and low volatility. 3. GBP/USD – High Volatility, High Opportunity Although a little more volatile, GBP/USD enables beginners to capitalize from large price fluctuations. 4. USD/CHF – Safe Haven Currency Your trading portfolio will be more balanced because this pair is stable in times of global uncertainty. 5. AUD/USD – Commodity-Linked Pair AUD/USD provides great learning opportunities by tracking global commodity trends, such as those of gold and iron. 6. USD/CAD – Oil-Influenced Pair Due to its strong correlation with the price of crude oil, USD/CAD is a good choice for traders who are interested in fundamentals. 7. EUR/JPY – Trend-Friendly Pair Trend analysis is made easier by the combination of European and Japanese currencies. 8. GBP/JPY – Volatile but Beneficial This pair has significant price swings, making it ideal for beginners who are willing to take measured chances. 9. NZD/USD – Low Volatility Beginners can practice technical analysis with the controlled movements of NZD/USD. 10. EUR/GBP – Regional Stability This pair is perfect for traders concentrating on European markets because it is steady and predictable. Why Beginners Should Trade These Top 10 Currency Pairs Focusing on the top 10 currency pairs for forex trading provides: Beginners can trade safely and rapidly improve their skills by beginning with these pairs. Top Forex Pairs for Traders in India The top ten currency pairs for forex trading, such as EUR/USD, GBP/USD, and USD/JPY, are extensively supported by brokers and correspond with Indian trading hours for Indian traders. For reduced risk and improved outcomes, beginners can practice with these pairs. Start trading today with a trusted platform. Start Your Forex Trading Journey with The Safe Trader The best way to lower risk, acquire experience, and boost market confidence is to begin your Forex journey with the top 10 currency pairs. You can increase your chances of success and ensure a smoother learning curve by concentrating on highly liquid, stable, and widely traded pairs. When you combine this with appropriate training, such as The Safe Trader Academy forex trading course, you can become an expert in market analysis, risk management, and strategy. Learn, practice, and trade the top 10 currency pairs for forex trading with confidence, clarity, and the help of reliable mentors. Start now. Your successful Forex adventure begins right now! Read more: Technical Analysis Course India | Future and Options Trading Course | Equity Investment Course | Professional Stock Trading Course | Smart Money Concepts Course 👉 Website: www.thesafetrader.in👉 Phone/WhatsApp: +91 9297506666 Disclaimer:The information provided here is purely for educational and informational purposes only and reflects our personal analysis and opinions. This course is for educational purposes only. We are not SEBI-registered advisors.

What Are the Sessions in Forex Trading & Why Are They Important?

Although forex trading takes place around the clock, the market does not always act in the same way. The time of day affects price movement, volatility, and trading opportunities. Forex trading sessions are these particular intervals of time. Knowing the hours of the forex market is important whether you are just getting started or are already trading from India. You can avoid incorrect setups, better manage risk, and trade with greater confidence if you know when to trade. This knowledge is especially important for forex for beginners, who frequently miss money because of bad timing rather than bad strategy. What Are Forex Trading Sessions? Based on the top financial hubs in the world, the global Forex market is split into four major trading sessions. Every session has distinct traits, degrees of volatility, and optimal trading 1. Asian Session (Tokyo Session) Time: 5:30 AM to 2:30 PM IST 2. London Session Time: 1:30 PM to 10:30 PM IST 3. New York Session Time: 6:30 PM to 3:30 AM IST 4. Sydney Session Time: 3:30 AM to 12:30 PM IST Why Forex Trading Sessions Are Important 1. Helps You Trade at the Right Time Losses are frequently the result of trading at random throughout the day. You can trade during high-volume times when the market is more predictable if you understand forex trading sessions. 2. Improves Risk Management Over the course of the forex market, volatility fluctuates. Understanding session behavior enables you to: 3. Prevents Unnecessary Losses When trading during times of low liquidity, many beginners lose money. You can concentrate exclusively on highly probable setups with the aid of sessions. Best Forex Trading Course by The Safe Trader The first step is to understand forex trading sessions; however, proper training, strategy, and mentorship are necessary for long-term success. This course on forex trading will teach you: The Safe Trader Academy’s forex trading course is made to help you trade with clarity and confidence if you genuinely want to become an expert in the market. Real market behavior, session-based strategies, and expert risk management techniques are the main topics of this expert-led forex trading course. Read more: Technical Analysis Course India | Future and Options Trading Course | Equity Investment Course | Professional Stock Trading Course | Smart Money Concepts Course 👉 Website: www.thesafetrader.in👉 Phone/WhatsApp: +91 9297506666 Disclaimer:The information provided here is purely for educational and informational purposes only and reflects our personal analysis and opinions. This course is for educational purposes only. We are not SEBI-registered advisors.

Top 10 Stock Market Training Institutes in India

India’s most trusted Top 10 Stock Market Training Institutes in India for beginners & professionals. The initial and most important phase in developing an effective trading or investing career is selecting the Best Stock Market Training Institute in India. Traders now seek out institutions that provide hands-on training, real-world market exposure, and professional mentoring due to the rising demand for share market courses in India. Top 10 Stock Market Training Institutes in India Rank Institute Name Course Type Key Courses Offered Mode of Learning Best For 1 The Safe Trader Academy (Hyderabad, India) Professional Trader Course Technical Analysis, Futures & Options, Forex, Crypto, Intraday Trading & more Online & Offline Beginners to Professional Traders 2 NSE Academy Certification Programs Stock Market Basics, Derivatives Online & Classroom Certification-Oriented Learners 3 BSE Institute Ltd Academic Programs Capital Markets, Financial Markets Classroom & Online Finance Students 4 Sharekhan Education Investor Training Equity, Mutual Funds Online Long-Term Investors 5 Edelweiss Learning Beginner Courses Stock Market Basics Online Entry-Level Traders 6 ICICI Direct CFL Market Education Equity, Derivatives Online Banking & Finance Learners 7 Zerodha Varsity Free Learning Platform Stock Market Basics, Options Online (Self-learning) Self-learners 8 Angel One Smart Money Platform-Based Learning Trading Basics Online New Traders 9 Upstox Learning Centre Introductory Courses Equity & Derivatives Online Platform Users 10 Online Trading Gurus Generic Training Technical Analysis Online Casual Learners What Makes The Safe Trader Academy #1? Your trading journey can be completely changed by a great mentor. Industry expert Mr. Mallinath Mulage, a certified mentor with more than five years of experience and 5 NISM certifications, is the instructor for our stock market trading courses online at The Safe Trader Academy. He has personally guided more than 5,000+ students to explore the fundamentals of forex trading, options, futures, and technical and fundamental analysis. You will receive individualized mentoring and practical insights to assist you in making well-informed trading decisions through our share market online courses. What You’ll Learn at The Safe Trader Academy 45-Day Professional Trader Program ✅ Tools & Software for Trading & Investing✅ Basics of the Indian Share Market✅ Equity Investment✅ Fundamental & Technical Analysis✅ Futures & Options✅ Forex & Commodity Trading✅ Powerful Intraday Trading Strategies✅ Online & Offline Classes✅ Live Market Analysis & Handholding (3 Months)✅ 500+ Real-Time Market Assignments✅ One-on-One Interaction with Trainer & CEO✅ Zoom Recordings Provided for Every Class Why Choosing the Right Stock Market Training Institute Matters A reliable Stock Market Training Institute in India helps you: One of the most reputable Professional Trading Courses in India, The Safe Trader Academy goes beyond theory by providing real-time market exposure. Enroll Today – Start Your Professional Trading Journey Choosing the Best Stock Market Academy in India can transform your financial future if you’re serious about trading and investing. The Safe Trader Academy stands out among all the options because of its hands-on training, professional mentoring, and track record of student success. Read more: Technical Analysis Course India | Future and Options Trading Course | Equity Investment Course | Professional Stock Trading Course | Smart Money Concepts Course 👉 Website: www.thesafetrader.in👉 Phone/WhatsApp: +91 9297506666

Why Learning Investing From a Stock Market Academy Matters

Financial education and investing go hand in hand. Saving money is insufficient to accumulate wealth or secure your future in the rapidly evolving economy of today. Because of this, it is now crucial for everyone to learn how to invest through professional stock market courses from reputable stock market academies. The Safe Trader Academy is a preferred share market institution for beginners as well as professionals because we concentrate on fostering financial confidence through structured learning. Why Investing Is Important (Why Invest?) Investing helps your money grow, protects you from inflation, and creates long-term financial stability. It is now necessary to clarify why it is necessary to invest. Beat Inflation It is because inflation causes the value of money to diminish every year. If you keep your money idle, you will lose purchasing power. Stock market investment, mutual fund investment, or SIP investment is essential to overcome inflation. This concept is strongly emphasized in the best stock market courses in India, where learners understand how long-term investing outperforms savings. Achieve Financial Goals Investing enables you to reach financial objectives more quickly, whether they are home ownership, retirement planning, or educational funding. Every investor needs to learn goal-based investing, asset allocation, and disciplined planning, all of which are taught in a structured best stock market course. Power of Compounding Compounding allows your money to grow exponentially over time. The advantages increase with the age at which you begin investing. Every best stock market course, especially for beginners, teaches the fundamental idea of compounding. Create Multiple Income Sources Investing enables you to create a variety of revenue streams, including: Professional stock trading training teaches you how to diversify income sources and reduce financial dependence on a single salary. Secure Your Financial Future Long-term financial stability and peace of mind are guaranteed by investing. You can learn to safeguard capital while gradually increasing your wealth with the correct advice from a reputable share market institute. Build Discipline & Financial Knowledge Planning, perseverance, and discipline are necessary for successful investing. You can avoid making snap decisions and form these habits early by attending a professional stock market academy. Why Financial Education Is Important The foundation of wise investing is financial literacy. Even favorable opportunities can result in losses if one is ignorant. Helps You Make Smart Financial Decisions Understanding where to invest, how much risk to take, and when to sell is made possible by financial education. One of the main advantages of taking structured stock market courses rather than depending on advice or speculation is this clarity. Avoids Debt & Financial Stress Stress, excessive spending, and needless loans are frequently caused by a lack of financial literacy. The top share market courses help you stay debt-free by teaching planning, budgeting, and disciplined money management. Builds Wealth Over Time Consistency and wise choices lead to the gradual accumulation of wealth. Having a solid understanding of finance guarantees that you will remain confidently invested throughout market fluctuations. Protects You From Scams & Losses Fake tips and unrealistic promises cause a lot of people to lose money. Gaining knowledge from a reputable share market school shields you from fraud and impulsive trading errors. Essential Financial Skills You Learn A professional stock market academy covers all key financial pillars, including: These skills are crucial aspects of high-quality stock trading instruction. Why Learn With The Safe Trader Academy? At The Safe Trader Academy, learning is practical, action-based, and personalized to your goals. Here’s what makes our courses truly stand out: ✅ Tools & Software for Trading & Investing✅ Basics of Indian Share Market✅ Equity Investment✅ Fundamental & Technical Analysis✅ Futures & Options✅ Forex & Commodity Trading✅ Powerful Intraday Trading Strategies✅ Online & Offline Classes Available✅ Live Market Analysis & Handholding (3 Months)✅ 500+ Real-Time Market Assignments✅ One-on-One Interaction with Our Trainer & CEO✅ Zoom Recordings for Every Class✅ Intraday Setup for Indian and Forex Markets✅ Free Access to Upcoming Batches Start Your Financial Journey Today Investing without knowledge is risky – but investing with the right education is powerful. Join The Safe Trader Academy and enroll in one of the best course for stock market learning to build wealth with confidence, clarity, and discipline. 👉 Website: www.thesafetrader.in👉 Phone/WhatsApp: +91 9297506666

What Is a Range-Bound Market?

A range-bound market typically describes price movement between fixed support and resistance levels without a clear trend in the price of a security. The concept of a range-bound market is usually one of those points introduced or covered in courses about stock market trading for beginners or intermediate traders. In The Safe Trader Academy, a leading stock market academy, traders learn just how to identify the consolidation phase and how to trade it with confidence using time-tested strategies. Understanding a Range-Bound Market in Simple Terms During a range-bound market, prices tend to keep oscillating between specific ranges. This marked has also been referred to as market consolidation, whereby neither market buyers nor sellers dominated. Important features are: Learning this concept is essential in any best stock market course, especially for beginners aiming for consistency. Why a Range-Bound Market Matters for Traders Beginning traders often result in losses because they use trending models in a rangebound market. An organized stock market tutorial teaches you to change your strategies according to the type of market. Key characteristics include: This is the reason why The Safe Trader Academy is considered the best stock market institute for serious learners. How to Identify a Range-Bound Market 1. Support and Resistance Levels 2. Flat Moving Averages 3. Indicator Confirmation Indicators assist to confirm consolidation: These indicator-based confirmations are part of our advanced stock market course curriculum. Best Strategies to Trade a Range-Bound Market Strategy 1: Buy at Support – Sell at Resistance This is the most reliable range-bound market strategy. Strategy 2: RSI Mean Reversion Strategy The Relative Strength Index is highly effective in ranging markets. RSI around 30 → Buy RSI approaching 70 → Sell Strategy 3: Bollinger Band Range Trading When Bollinger Bands compress, it indicates consolidation. Common Mistakes to Avoid in a Range-Bound Market Range-Bound Market vs Trending Market Range-Bound Market Trending Market Sideways movement Strong direction Support-resistance trades Breakout trades Mean reversion works Trend following works Understanding this difference is a core part of any high-quality stock market course. What Makes The Safe Trader India’s Top Trading Academy? At The Safe Trader Academy, learning is practical, action-based, and personalized to your goals. Here’s what makes our courses truly stand out: ✅ Tools & Software for Trading & Investing✅ Basics of Indian Share Market✅ Equity Investment✅ Fundamental & Technical Analysis✅ Futures & Options✅ Forex & Commodity Trading✅ Powerful Intraday Trading Strategies✅ Online & Offline Classes Available✅ Live Market Analysis & Handholding (3 Months)✅ 500+ Real-Time Market Assignments✅ One-on-One Interaction with Our Trainer & CEO✅ Zoom Recordings for Every Class✅ Intraday Setup for Indian and Forex Markets✅ Free Access to Upcoming Batches Guidance from Expert Mentors Your trading journey can be completely changed by a great mentor. Industry expert Mr. Mallinath Mulage, a certified mentor with more than five years of experience and 5 NISM certifications, is the instructor for our stock market trading courses online at The Safe Trader Academy. He has personally guided more than 5,000+ students to explore the fundamentals of forex trading, options, futures, and technical and fundamental analysis. You will receive individualized mentoring and practical insights to assist you in making well-informed trading decisions through our share market online courses. Enroll Today – Start Your Professional Trading Journey Mastering the range-bound market helps you trade with clarity instead of confusion. If you want to join a best stock market institute in India, now is the right time. Our 45-Day Intensive Stock Market Course gives you everything you need to trade confidently – from basics to advanced strategies. 👉 Website: www.thesafetrader.in👉 Phone/WhatsApp: +91 9297506666

5 Best Tips to Save Money and Start Investing

The 5 Best Tips to Save Money and Start Investing can assist you in learning how to manage your finances effectively, cut back on unnecessary spending, and start your wealth accumulation path with optimism. Looking for solutions to where your money is going each month or how you can invest without worries? At The Safe Trader Academy, we think that anyone can learn how to save money and make smart investments if they are given the correct guidance. Let’s examine useful, approachable methods that you can begin utilizing right now. Why Saving Money Is the First Step Before Investing Saving money before proceeding to investments is important. Many people want to invest but struggle because they don’t manage expenses properly. Therefore, learning these “Best 5 Tips to Save Money and Start Investing” will assist you in creating a solid financial base. Saving gives you: After you establish a savings habit, you can invest with ease. 1: Track Your Expenses and Control Spending One key tip on Save Money and Start Investing includes the issue of comprehension regarding where the money goes. Most people overspend without realizing it. Start by: By keeping track of expenses, you open up space for cash that can then be invested. This habit alone can change your financial life. 2: Set Clear Financial Goals Before Investing Perhaps the most overlooked of the top 5 Tips to Save Money and Start Investing is setting goals-and it is arguably among the most important ones. Without goals, investing becomes a pretty arbitrary and emotional activity. Ask yourself: Clear goals help you on the right path of investment and also sustain discipline during market ups and downs. 3: Build an Emergency Fund First Experts particularly recommend one of the 5 Tips to Save Money and Start Investing: creating an emergency fund. This is a fund to keep your investments safe in case of an unexpected situation. Ideally, save: You won’t have to sell your investments too soon if you have an emergency fund, which will help you remain steady and self-assured. 4: Start Small but Invest Regularly Many beginners think it takes a lot of money to invest. That is untrue. Starting small but maintaining consistency is one of the Top 5 Ways to Save Money and Begin Investing. You are able to: Size is not as important as consistency. Over time, consistent investing generates wealth and builds discipline. 5: Educate Yourself Before Investing Financial education is the last and most effective of the 5 Best Tips to Save Money and Start Investing. Losses and anxiety are common outcomes of ignorant investing. Learning basics like: At The Safe Trader Academy, we assist beginners in understanding investing concepts in a straightforward, useful method so they can make well-informed decisions rather than speculating. Why Learning from the Right Platform Matters Your financial stability may suffer if you follow random advice from social media. For this reason, expert advice is important. At The Safe Trader Academy, we emphasize hands-on learning that enables you to put these money-saving and investing strategies into practice. Our approach emphasizes: For beginners, this makes learning simpler and investing safer. How Saving and Investing Work Together Investing and saving should be performed together, not separately. While investing allows your money to grow, saving provides stability. You can build a balanced financial system that supports your future objectives by following to the top 5 Tips to Save Money and Start Investing. You can gradually achieve financial independence, boost confidence, and lessen stress by saving and investing carefully. Start Your Smart Financial Journey Today Applying these 5 Best Tips to Save Money and Start Investing Consistently is a good place to start if you’re serious about improving your financial standing. Small actions taken today can create massive results in the future. 👉 Website: www.thesafetrader.in👉 Phone/WhatsApp: +91 9297506666